Do you hope to find 'tobacco tax essay'? You will find your answers right here.

Table of contents

- Tobacco tax essay in 2021

- What is the tax on cigarettes called

- Argumentative essay on banning cigarettes

- Effects of smoking cigarettes essay

- Tobacco tax philippines

- Benefits of increasing tax on cigarettes

- Disadvantages of tax on cigarettes

- The effect of smoking essay

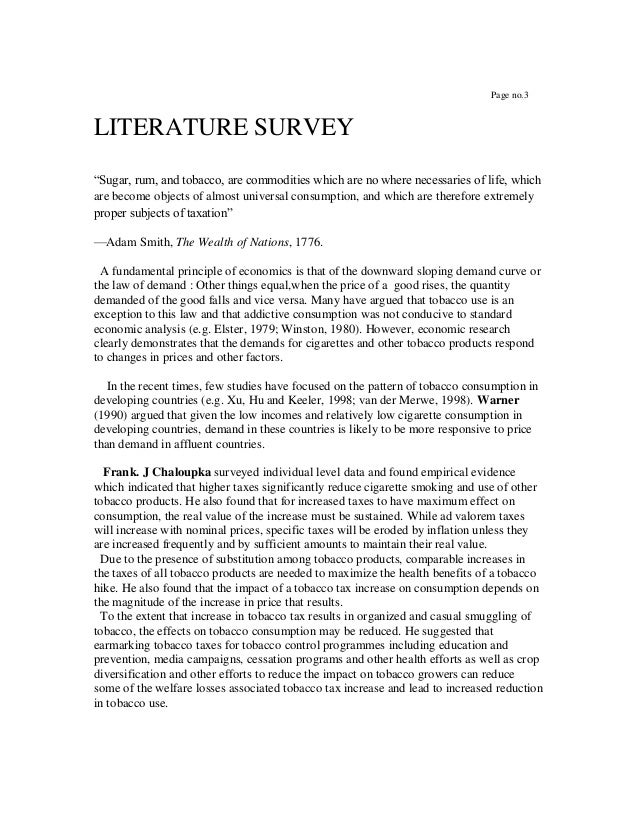

Tobacco tax essay in 2021

This image demonstrates tobacco tax essay.

This image demonstrates tobacco tax essay.

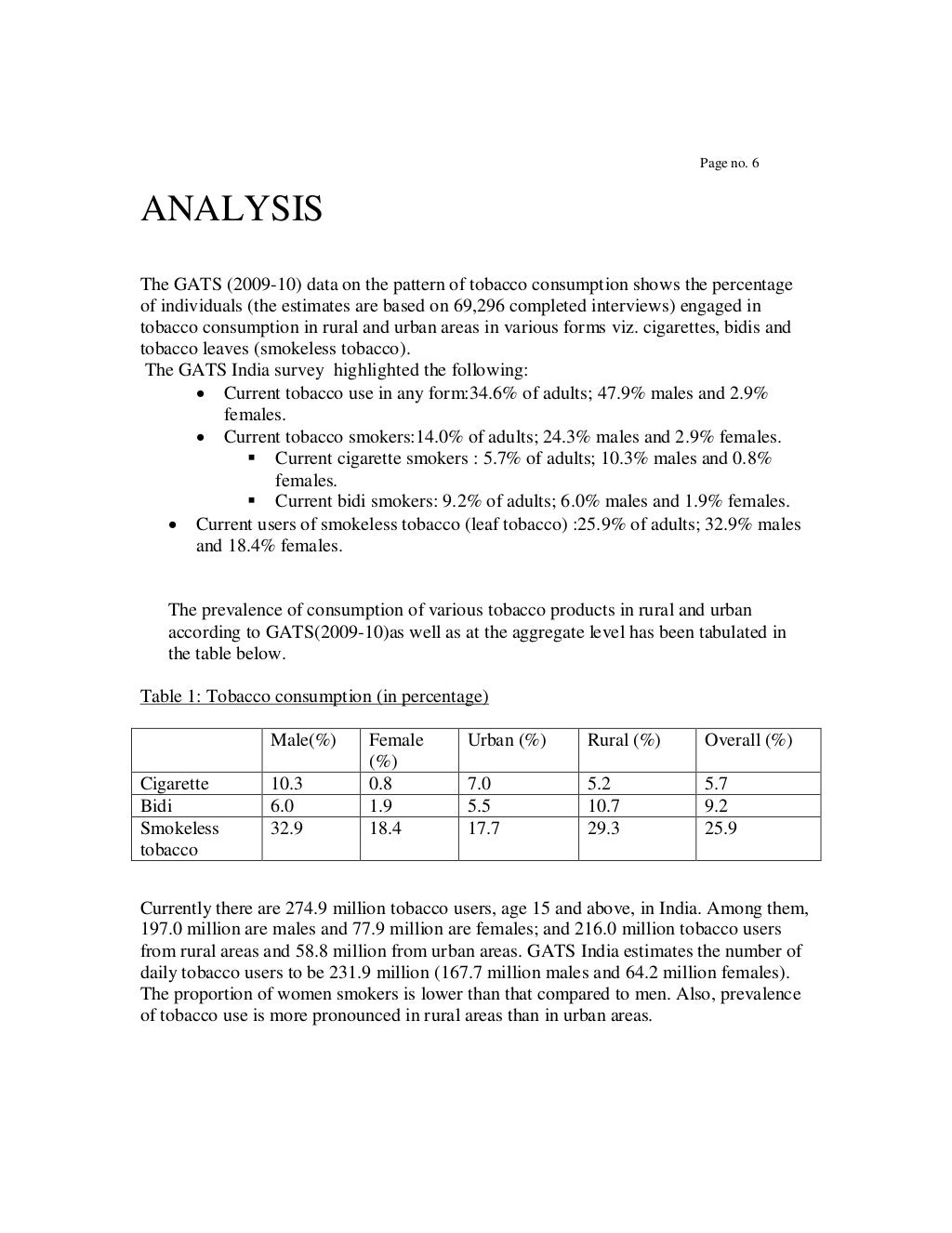

What is the tax on cigarettes called

This image representes What is the tax on cigarettes called.

This image representes What is the tax on cigarettes called.

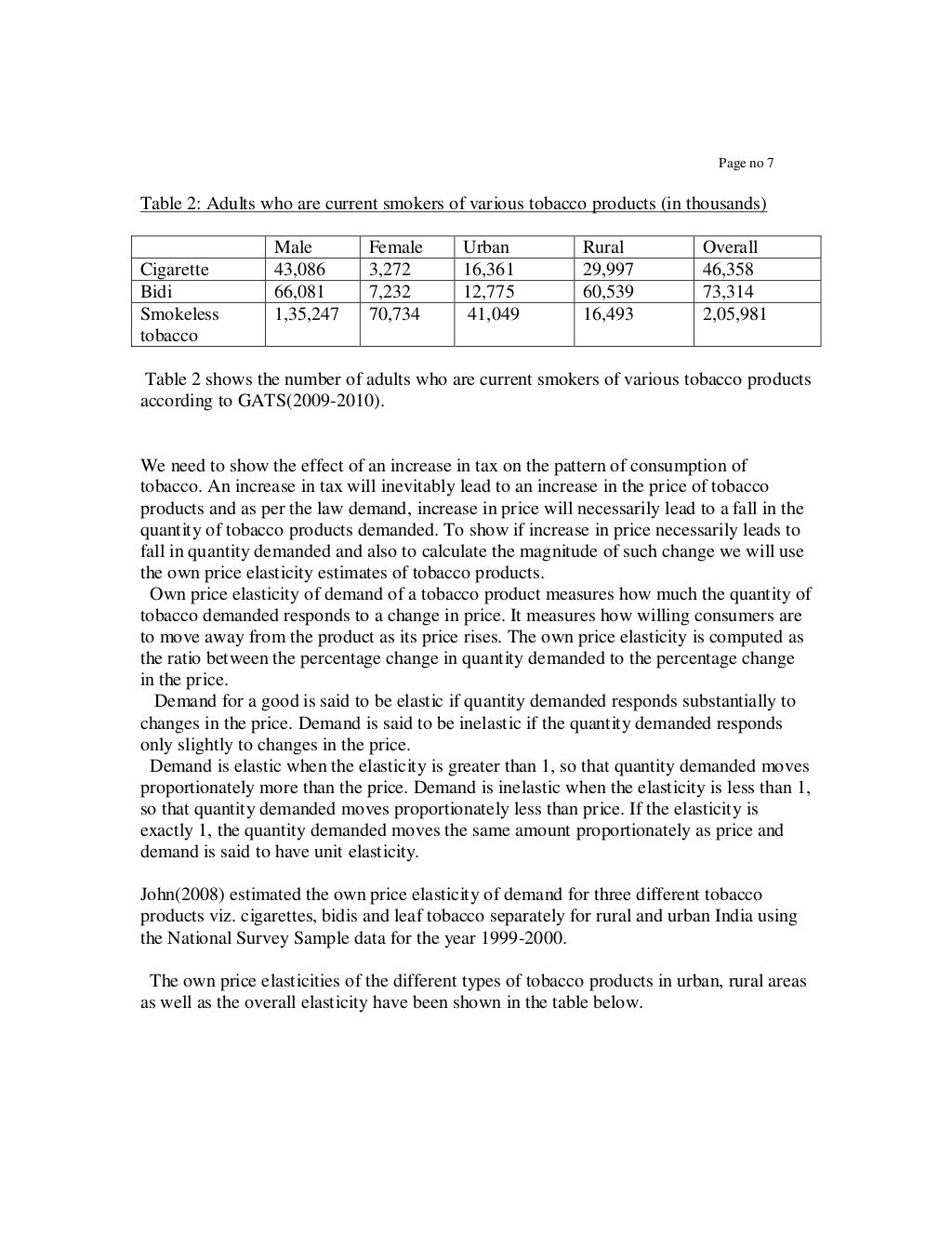

Argumentative essay on banning cigarettes

This picture representes Argumentative essay on banning cigarettes.

This picture representes Argumentative essay on banning cigarettes.

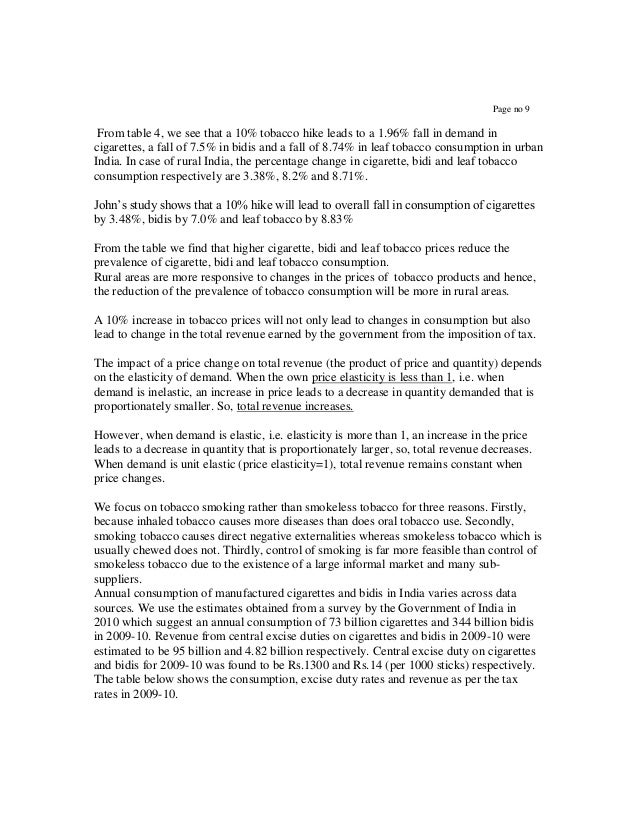

Effects of smoking cigarettes essay

This image representes Effects of smoking cigarettes essay.

This image representes Effects of smoking cigarettes essay.

Tobacco tax philippines

This image demonstrates Tobacco tax philippines.

This image demonstrates Tobacco tax philippines.

Benefits of increasing tax on cigarettes

This picture shows Benefits of increasing tax on cigarettes.

This picture shows Benefits of increasing tax on cigarettes.

Disadvantages of tax on cigarettes

This picture demonstrates Disadvantages of tax on cigarettes.

This picture demonstrates Disadvantages of tax on cigarettes.

The effect of smoking essay

This picture representes The effect of smoking essay.

This picture representes The effect of smoking essay.

Why do we need to pay for tobacco excises?

Also, the increased tax revenue is then used to pay for the externalities that are caused by the consumption of tobacco, i.e. pay for health rehabilitation centres for smoking related diseases. ‘Excises are often rationalised as charges for the external cost that consumers or producers of excisable products impose on others.’

When did the federal tax on cigars increase?

Despite a continued decrease in cigarette smoking in the U.S., consumption of large cigars has increased substantially since the federal tobacco tax increased in 2009.

What are the effects of taxes on tobacco?

While not as widely studied, tax increases on other tobacco products, such as cigars and smokeless tobacco, yield similar results in terms of reducing prevalence and consumption. A study of the 2009 federal tax increase on smokeless tobacco led to at least 135,000 fewer users immediately after the increase took effect.

Why is it important to raise the price of tobacco?

Indeed, raising taxes on tobacco and thereby increasing its price is one of the most effective ways to reduce tobacco use. Prices affect virtually all measures of cigarette use, including per-capita consumption, smoking rates and the number of cigarettes smoked daily. These effects apply across a wide range of racial and socioeconomic groups.

Last Update: Oct 2021