Are you scouring the internet for 'tax outline'? Here you can find the answers.

Table of contents

- Tax outline in 2021

- Barbri tax outline

- Federal income tax outline 2020

- Federal income tax law school flowchart

- Partnership tax outline

- Federal income tax outline flowchart

- State and local tax outline

- Business tax outline

Tax outline in 2021

This image shows tax outline.

This image shows tax outline.

Barbri tax outline

This image shows Barbri tax outline.

This image shows Barbri tax outline.

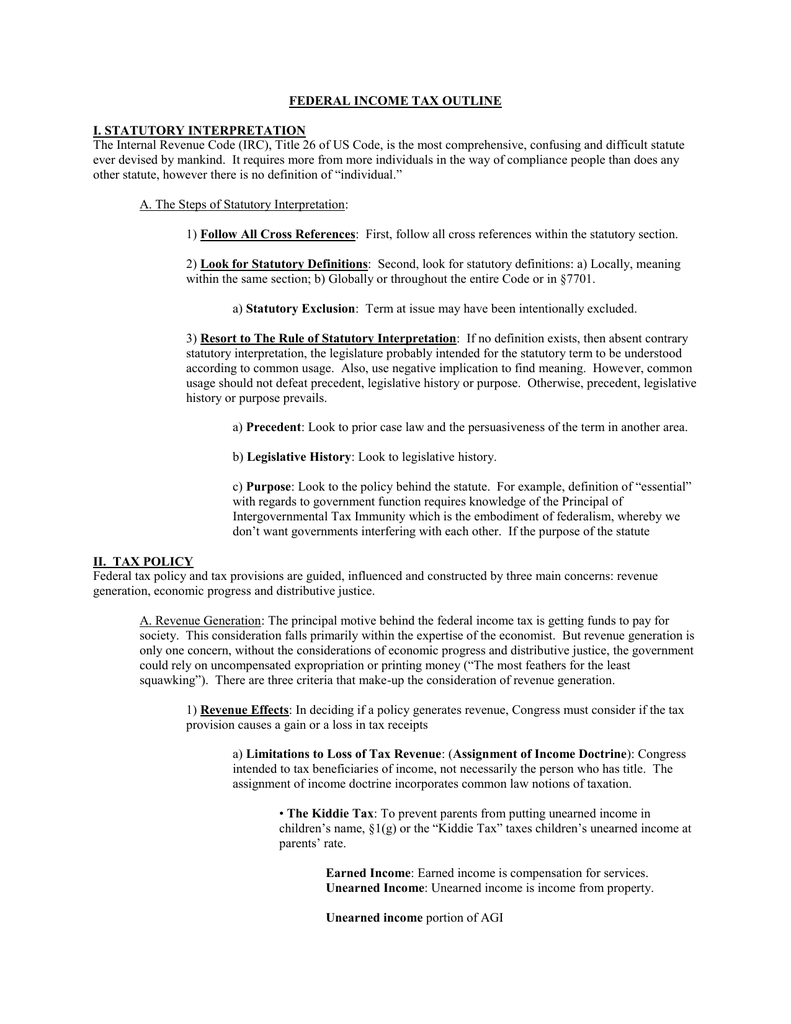

Federal income tax outline 2020

This image illustrates Federal income tax outline 2020.

This image illustrates Federal income tax outline 2020.

Federal income tax law school flowchart

This image representes Federal income tax law school flowchart.

This image representes Federal income tax law school flowchart.

Partnership tax outline

This picture representes Partnership tax outline.

This picture representes Partnership tax outline.

Federal income tax outline flowchart

This picture illustrates Federal income tax outline flowchart.

This picture illustrates Federal income tax outline flowchart.

State and local tax outline

This image demonstrates State and local tax outline.

This image demonstrates State and local tax outline.

Business tax outline

This picture representes Business tax outline.

This picture representes Business tax outline.

How to get a wwts tax summaries online?

Please try again. Please contact for general WWTS inquiries and website support. By submitting your email address, you acknowledge that you have read the Privacy Statement and that you consent to our processing data in accordance with the Privacy Statement.

What do you need to know about taxation?

This course introduces the general principles of taxation and statutory provisions on income taxation including pertinent revenue regulations.

Why is the Blue form tax system important?

The blue form tax return system is intended to encourage better, uniform and systematic record keeping and reporting by corporate taxpayers by offering certain benefits and preferential tax treatment to approved blue form taxpayers. The blue form tax return is not only limited to corporate taxpayers but can also be used by individual taxpayers.

What are the main topics in the taxation syllabus?

The main topics that will be covered include: the general principles of taxation, sources of income, determining income from employment, income from a business, and income from property, deductions from business and property income, capital gains and losses, other income and deductions, computation of taxable income and tax administration

Last Update: Oct 2021

Leave a reply

Comments

Bonzie

20.10.2021 04:13If tp allows 90 days to lapsing, then he has lost the chance to go to the u. The alternate minimum tax for individuals outline away richard e.

Edelina

22.10.2021 10:41Menage democrats outline revenue enhancement increases for flush businesses and individuals.